Authors

Jenny Kwan (WBCSD), Inês Amorim (WBCSD), Vignesh Gowrishankar (BCG), Elfrun von Koeller (BCG), Anastasia Kouvela (BCG), Alice Bolton (BCG), Lorenzo Fantini (BCG)

15%

Only 15% of companies disclosing to CDP have a dedicated C-suite position for sustainability, such as chief sustainability officers

21%

Only 21% of companies surveyed by S&P have a climate adaptation plan in place to respond to climate risks across their value chain

High-level climate strategies are great on paper, but they only work if everyone in the company understands their part in making them happen. Without that broad awareness and practical know-how, even the best plans can miss the mark.

– Challenges identified by practitioners

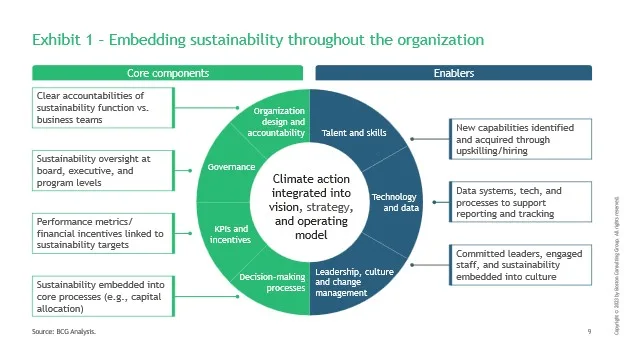

Cross-organization activation and buy-in are essential to corporate climate action (see Exhibit 1). A thoughtfully designed and executed activation plan is necessary to counteract a natural resistance to change, which is well-documented in behavioral science as cognitive inertia. People prefer familiar routines over new approaches, despite evidence that potential gains outweigh potential losses.

So how to overcome this cognitive inertia? Our discussions with companies revealed several key unlocks in organizational activation for climate action:

- Leveraging the cost of inaction as a call to action.

- Establishing robust sustainability governance and teams.

- Aligning financial risks and returns with sustainability goals.

- Cultivating a corporate culture of sustainability.

- Adopting unified data systems and frameworks to drive consistent action.

Leverage the cost of inaction as a call to action

WBCSD Member Insights

Often when people hear ‘sustainability,’ the project gets deprioritized and becomes a nice-to-have. If you can’t get people to understand there is real operational risk and something material will happen, you can’t convince people to take action.

Many sustainability practitioners struggle to convey the urgency and business relevance of climate action and adaptation to the broader organization. For example, an industrial technology company faced resistance from business units to deploy adaptation and resilience measures because significant operational impacts were not yet apparent. Similarly, a real estate conglomerate, despite experiencing asset closures due to flooding and heat waves, struggled to generate buy-in for future-focused adaptation and resilience efforts.

In 2024, the ten most expensive climate-related disasters collectively caused an estimated USD 229 billion in damages and claimed over 2,000 lives. Highlighting the cost of inaction can be a powerful motivator for sustainability efforts, especially when closely tied to the company’s overall vision and strategy. The argument can clearly establish a compelling connection between inaction, its sustainability and business costs, and the resulting setbacks and lost opportunities in relation to the company’s key objectives. Based on conversations with leading companies, the following tips may be helpful for framing the cost of inaction as a call to decisive climate action:

- Focus on material risks that are recognizable across functions.

- Quantify potential operational impacts (forced downtime, asset damage, etc.) and financial effects (for example, EBITDA at risk) and drawing a clear link from risk to operational and financial outcomes. Importantly, lost business opportunities may also be contemplated when assessing inaction or delayed action.

- Use site-specific data points whenever possible, as regional proxies may not resonate with on-the-ground stakeholders.

- Leverage past incidents, both firsthand experiences and relevant case studies, to illustrate how future risks could escalate.

Establish robust sustainability governance and teams

WBCSD Member Insights

Governance bodies should be cross-functional to address sustainability comprehensively, avoiding fragmentation, gaps, and redundancies, as highlighted by a leading food and beverage company.

Robust governance is essential for integrating sustainability efforts into core organizational processes, such as corporate planning and operational execution. Yet fewer than 15% of companies publicly disclosing their CDP responses have dedicated C-suite or similar visibility to sustainability, such as chief sustainability officers (CSOs).

At IKEA, the CSO sits on the executive board, with regional CEOs also serving as regional CSOs. ESG representatives are involved in decision-making at every level. At BASF, the executive board of directors itself holds ultimate responsibility for sustainability, having absorbed the responsibilities of the dedicated corporate sustainability board that acted as a central sustainability steering committee between 2013–23. In both cases, sustainability is deeply embedded into the highest levels of governance.

As a complement, central sustainability teams can act as “centers of excellence,” responsible for developing strategy and policy, providing expertise, and coordinating programs, while business units maintain executional ownership and clear accountability. Central sustainability teams are typically most effective when they have executive visibility, preferably with the CSO at the CEO -1 level.

However, ownership of climate initiatives can be decentralized and disseminated throughout the organization with clear reporting and accountability mechanisms. Business units may be ultimately accountable for climate strategy execution, including alignment with business needs, initiative implementation, and program management, thus ensuring executional certainty.

Align financial incentives with sustainability goals

Incentives drive sustained performance. Leading companies link a meaningful share of compensation to sustainability outcomes, ensuring executives and team stary accountable. To motivate ongoing action, sustainability-linked incentives can be cascaded throughout the organization.

At Mars, more than 1,700 senior leaders receive a long-term incentive award with 20% of the payout linked to sustainability measures. Over 400 top senior leaders receive an additional long-term incentive award with a 40% payout linked to sustainability measures.

At Diageo, executives down to team managers are eligible for tailored incentives, with 20% of long-term incentive plan grants for all senior leaders tied to performance against the company’s priority ESG targets, including emissions reduction and water efficiency.

Incentives should be differentiated by roles and levels of influence, and large enough to prompt action (typically more than 20% of the total incentive package).

Cultivate a corporate culture of sustainability

WBCSD Member Insights

Don’t ask your teams to do three things when you can frame one action as delivering three benefits.

Catalyzing and sustaining climate action requires a deliberate cultural shift. The following actions can help with cultivating that culture:

- Articulate a compelling vision. Develop a purpose-driven, fact-based case for change that aligns sustainability to business priorities and resonates with the greater good.

- Leverage storytelling to make it real. Use narratives to illustrate how sustainability initiatives drive tangible benefits for the end consumer, weaving in elements that can easily resonate (for example, safety for one’s family). For example, household products brand Seventh Generation uses storytelling to communicate that the company’s commitment to the planet is consistent with the elevated value that it provides its end customers.

- Hardwire sustainability into daily operations. Some companies build sustainability KPIs directly into their competitive dashboards. Microsoft developed the Emissions Impact Dashboard, a free dashboard accessible to customers to track the impact of Microsoft Cloud.

- Invest in climate upskilling. Many programs focus on general climate science and corporate policy literacy, but that is not enough. Companies would do well to explain the “why” behind climate efforts, as well as the “what” and “how” of employees’ specific roles in driving change. This includes equipping employees with role-specific skills to take actionable steps, such as applying a new sustainability benchmark, and showing how these efforts align with broader climate goals. New tools can be integrated into existing workflows from day one to ensure seamless adoption.

Blueprints for Success

HSBC provides tailored climate learning pathways, focusing on practical capabilities. Its Sustainability Academy offers more than 200 modules; the “Net Zero in Practice” series features live briefings from Center of Excellence experts; and an interactive workshop series offers role-specific upskilling.

Adopt unified data systems and frameworks to drive consistent action

We defined Scope 3 goals separately from circularity, which caused confusion.

– Challenges identified by practitioners

Many companies struggle with implementing sustainability efforts due to lack of coordination between data, planning, and execution. This challenge is amplified when individual sustainability initiatives—for example, climate mitigation, transition, adaptation, circularity, water, nature, and biodiversity—are perceived as misaligned, making integration difficult.

To address fragmentation and ensure cohesive, well-coordinated efforts, central sustainability teams can take the following actions:

- Provide enterprise-wide frameworks for data collection and action planning, while allowing local flexibility. For example, central teams at a food and beverage company can pre-populate risk assessment data using enterprise-level expertise, allowing decentralized teams to verify or correct the information based on their on-the-ground knowledge. See WBCSD’s adaptation planning guide below.

- Highlight the interconnected nature of sustainability efforts, which often deliver multiple desired outcomes. For example, using distributed renewable energy not only reduces greenhouse gas emissions but also enhances resilience against climate events by complementing the central grid, and delivers cost savings.

No-regret foundational moves

- Quantify and communicate the cost of inaction. Highlight tangible financial and operational impacts of a manageable number of material climate risks to demonstrate the urgency of proactive measures. Use specific data points, past incidents, and case studies to make risks relatable and drive organizational buy-in.

- Appoint visible climate leadership. Appoint a climate leader or integrate sustainability leadership into the existing executive team to ensure climate initiatives are embedded into core decision-making and corporate strategy.

- Evolve internal sustainability training. Strengthen internal sustainability training and messaging by offering more role-specific tools and guidance.

Further reading

Outline