Authors

Davide Fiedler

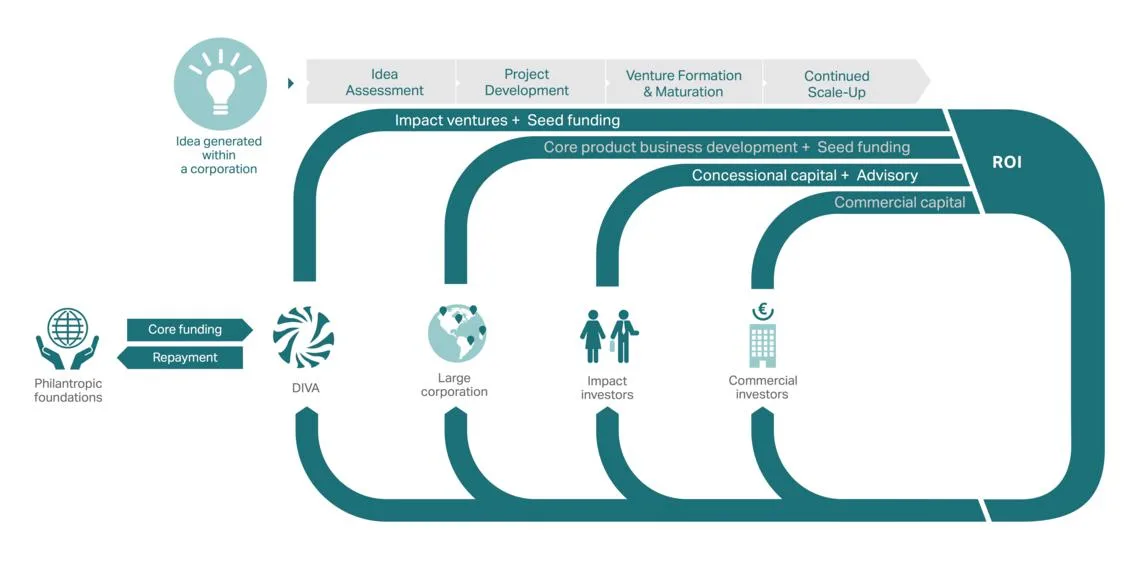

DIVA was launched in 2015 by Novozymes, DSM, Pillsbury and WBCSD as a not-for-profit entity to co-develop inclusive business ideas into investable ventures, and to co-invest with corporations to overcome the pioneer gap and ultimately bring an impact venture to scale. Its experience to date suggests that there is great potential, but one gap still remains to be bridged.

Profitable business solutions that deliver impact at scale – so called impact ventures – can attract commercial capital and will play an important role in mobilizing the $2.4 trillion in investment needed every year to achieve the Sustainable Development Goals (SDGs). A new WBCSD case study analyses Driving Impact Venture Action (DIVA)’s experiences in supporting corporate impact venturing.

Large corporations are uniquely positioned to develop impact ventures but face significant barriers. Costs may be higher, margins may initially be lower, and the time required to break even may be longer than for other innovation investments a large corporation could make. Pursuing impact ventures is often associated with an opportunity cost.

In addition, when new business ideas involve unfamiliar markets or business models, corporations may find that they lack the knowledge, skills, or systems required to execute successfully. The combination of capability gaps and opportunity costs results in a “pioneer gap” for corporate impact ventures – a lack of resources for the early stages of venture creation and development.

To support DIVA in gaining further traction, WBCSD published a case study that analyses DIVA’s journey so far and identifies three trends:

- Forward-looking multinationals are lining up to co-develop and co-invest in ventures with DIVA;

- Impact investors are keen to fund corporate-backed ventures;

- Progressive philanthropic organizations are willing to support individual ventures in DIVA’s portfolio.

However, there is one important gap that remains to be filled: As a not-for-profit partner sharing the cost and risk, DIVA is designed to help corporations take the first steps. However, DIVA’s ability to support corporate impact ventures depends on philanthropic support to fund its core activities and mature the DIVA organization, expand the partnership base, and engage in more early-stage venture development projects. This will ultimately allow the development and more importantly the scaling up of impact ventures that deliver impact at scale and contribute to achieving the SDGs.

For more information contact Filippo Veglio veglio@wbcsd.org

WBCSD news articles and insights may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Privacy Policy. All Content must be featured with due credits.

Related

Content

Getting ready to reach new heights of sustainable business leadership

13 December, 2021

UNICEF and WBCSD launch guidance for business leaders on how to step up efforts to eliminate child labor

10 December, 2021

Vision 2050 Health & Wellbeing Pathway: We can help people feel better

30 November, 2021