Our previous article, Financial quantification: navigating the greenium and revenue management, explored how businesses are able to capture a price premium in sustainable products and services. In capital markets, the concept plays out differently. Here, the financing “greenium” refers to the willingness of investors to pay higher valuations or accept lower yields for companies and projects aligned with sustainability.1 The effect is expressed not in product margins, but in the discount rate used to value a company — the weighted average cost of capital (WACC).2

Why the discount rate matters

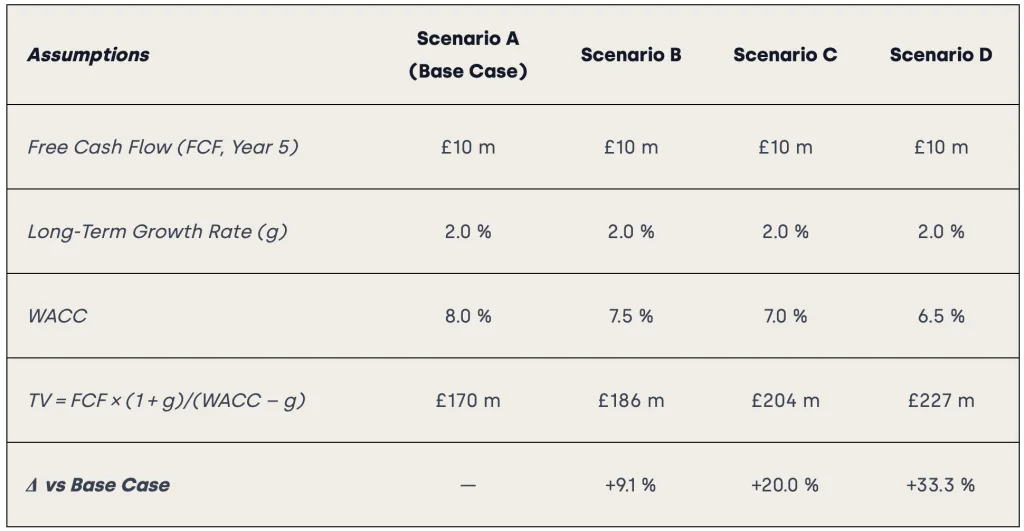

The discount rate determines the present value of a company’s future cash flows. Even small changes in WACC have significant effects on valuation.

For example, in discounted cash flow (DCF) models, terminal value (TV) — the component that reflects value beyond the explicit forecast period — can account for over 70% of enterprise value.3 TV is ultimately a function of two inputs: long-term growth and the discount rate. Of these, WACC is often the decisive lever.

A one-percentage-point difference in WACC can flip an investment from unviable to profitable. In a solar PV case discussed during a recent WBCSD–ERM workshop, the project was financially unattractive at an 8% WACC but viable at 7% (see Table 1).

These sensitivities explain how modest shifts can move the needle: a 50 bps reduction in WACC (8 → 7.5%) lifts terminal value by ~9%; a full point by ~20%. The financing greenium, though numerically small, deserves strategic attention.

Beyond the financing greenium: what really drives terminal value

The financing greenium improves TV by lowering WACC. However, the greenium impact is typically in the range of only a few basis points (bps): in recent years, corporate green bonds have priced around 1–6 bps tighter than conventional debt, with outliers near 15–20.4,5,6 While real, these differences are modest compared to long-term yield (cost of equity) movements of 50–100 bps.7 Changes in market perception — lower perceived transition risk, lower beta, or broader investor demand — of this size can be enough to materially affect valuation.

This makes it important to place the greenium within broader scenario and sensitivity analysis. Rather than treating greenium as a guaranteed financing advantage, business leaders should test TV across a range of WACC assumptions, both with and without a greenium. In parallel, they should ensure growth assumptions capture climate resilience and transition risks and opportunities in the context of their sector.

For near-term projects and investment decisions, traditional tools such as net present value (NPV) and internal rate of return (IRR) are effective. Measures like energy efficiency retrofits, on-site solar, or waste reduction typically deliver savings within a few years and can be assessed using these project-specific cash flow metrics.8,9 However, TV — a critical element of corporate valuation — is shaped by longer-term assumptions such as carbon pricing, water scarcity, and demand shifts. TV captures expected cash flows beyond the forecast horizon, embedding assumptions about long-term growth and resilience. Ignoring these can over-state the role of financing spreads.

Case study: Shell Plc

Shell’s 2024 Annual Report illustrates how to embed climate scenarios in valuation. The company stress-tested the carrying value of assets under multiple climate and carbon price pathways. Applying the IEA Net Zero Emissions by 2050 (NZE50) scenario, Shell estimated recoverable amounts of $26–$34 billion lower than current carrying values across its Integrated Oil & Gas portfolios. It also integrates escalating carbon prices, from around $100 per tonne in 2030 to as high as $230 by mid-century. Shell applies differentiated discount rates — 7.5% for oil and gas business activities, 6% for power and renewables — recalibrated annually against market yields and risk premiums. This approach illustrates how sensitivity and scenario analysis, incorporating WACC and carbon price assumptions, can turn climate uncertainty into financial insight.10

Lessons for business leaders

- Quantify, don’t just describe. Translate transition variables — carbon prices, commodity sensitivities, and abatement costs — into explicit valuation inputs. Link sustainability outcomes directly to asset valuation so investors can see how strategy reduces risk and drives enterprise value.

- Stress-test across futures. Connect climate pathways to financial outcomes. Model how carbon prices, policy, or commodity trends affect long-term value through impairment tests, ROIC, and TV. Use scenario analysis for decision making, not merely disclosure.

- Embed sustainability into capital allocation. Reflect transition risks and opportunities in growth and discount-rate assumptions. Apply differentiated WACCs or hurdle rates across business lines to capture differences in resilience, ensuring sustainability influences where capital flows. See also the recent WBCSD report, A Practical Guide on Transition Plan Dependencies.11

Conclusion

The financing greenium is real but modest. It can marginally lower the discount rate — a factor with an outsized effect on valuation; however, its greater power is the potential to reframe sustainability as a financial lever. By linking sustainability outcomes to discount rate sensitivities, cash flow resilience, and ultimately enterprise value, CFOs and CSOs can position sustainability as a driver of financial competitiveness.

The next article will build on this by showing how to quantify sustainability through return and cash-flow metrics — bringing the discussion to the balance sheet.

For an overview of this series in the context of WBCSD and ERM’s collaboration on quantifying sustainability for corporate finance, see here.

- OECD. (2022). Greenium: Do Investors Pay a Premium for Green Bonds? Retrieved at: https://www.oecd-ilibrary.org/finance-and-investment/greenium-do-investors-pay-a-premium-for-green-bonds_640e36d3-en ↩︎

- Wall Street Prep. (2024). Terminal Value (DCF): Formula + Calculator. Retrieved at: https://www.wallstreetprep.com/knowledge/terminal-value/ ↩︎

- Wall Street Prep. (2024). Terminal Value (DCF): Formula + Calculator. Retrieved at: https://www.wallstreetprep.com/knowledge/terminal-value/ ↩︎

- Banque de France. (2024). Green Premium: Can Firms Fund Their Green Projects at a Lower Cost? Wall Street Prep. (2024). Terminal Value (DCF): Formula + Calculator. Retrieved at: https://www.wallstreetprep.com/knowledge/terminal-value/

https://www.banque-france.fr/en/publications-and-statistics/publications/green-premium-can-firms-fund-their-green-projects-lower-cost ↩︎ - MSCI. (2024). Is Greenium Evaporating in USD Corporate Bonds? Retrieved at: https://www.msci.com/research-and-insights/blog-post/is-greenium-evaporating-in-usd-corporate-bonds ↩︎

- Sciencedirect. (2025). Greenium fluctuations and climate awareness in the corporate bond market. Retrieved at: https://www.sciencedirect.com/science/article/pii/S1057521925003680 ↩︎

- The Wall Street Journal. (2025). Bonds & rates. Retrieved at: https://www.wsj.com/market-data/bonds ↩︎

- Corporate Finance Institute. (2024). Internal Rate of Return (IRR). Retrieved at: https://corporatefinanceinstitute.com/resources/valuation/internal-rate-of-return-irr/ ↩︎

- International Energy Agency. (2021). Net Zero by 2050: A Roadmap for the Global Energy Sector. Retrieved at: https://www.iea.org/reports/net-zero-by-2050 ↩︎

- Shell Plc. (2024). Annual Report and Accounts 2024: Consolidated Financial Statements. Retrieved at: https://www.shell.com/investors/results-and-reporting/annual-report.html ↩︎

- WBCSD. (2025). A Practical Guide on Transition Plan Dependencies. Retrieved at: https://www.wbcsd.org/resources/a-practical-guide-on-transition-plan-dependencies/ ↩︎

Outline