Authors

Jenny Kwan (WBCSD), Inês Amorim (WBCSD), Vignesh Gowrishankar (BCG), Elfrun von Koeller (BCG), Anastasia Kouvela (BCG), Elizabeth Hardin (BCG), Annika Zawadzki (BCG)

Headline stats:

1/3

Only one-third of companies disclosing to the CDP have implemented climate scenario analysis

50%

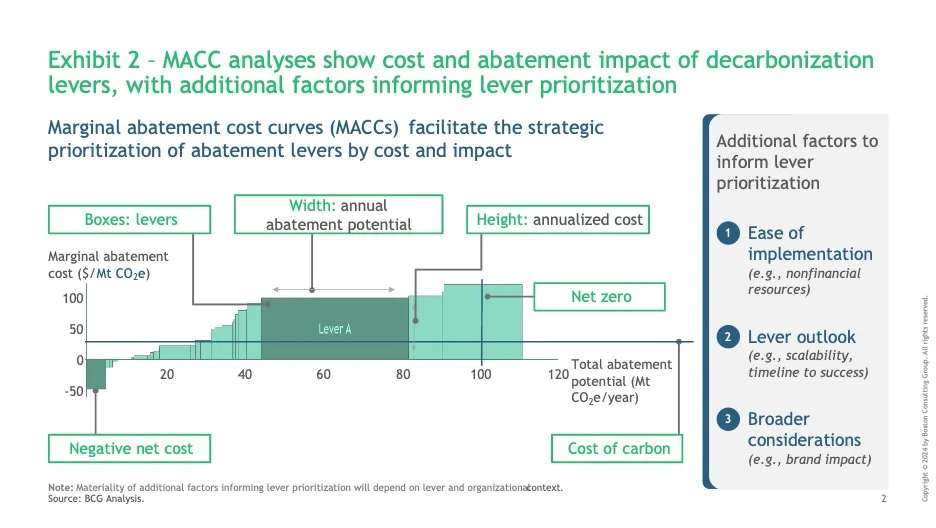

50% of Scopes 1 and 2 emissions reduction can be reached at net zero cost according to marginal abatement cost curve (MACC) analyses in key sectors

Long-term adaptation planning can create tension, as strategic planning typically follows three-to-five-year cycles, while climate-related risks are often perceived as distant or abstract concerns.

– Challenges identified by practitioners

We appreciate the value of MACCs in informing decarbonization strategies, but in practice, many of us struggle with quantifying the cost of emissions reductions, identifying viable pathways to net zero, and prioritizing decarbonization levers based on feasibility in different contexts.

– Challenges identified by practitioners

Integrating climate considerations into regular business operations is critical for accelerated and durable climate-related transformation, and it’s also a worthwhile business practice.

According to a recent Morgan Stanley survey, 85% of companies see sustainability as a value creation opportunity. In practice, however, climate business integration is fraught with challenges, including misaligned priorities among business units, limited internal expertise on climate science, and difficulties in quantifying sustainability’s business value in terms of risk and opportunity.

At the core of these challenges lies the need for companies to fundamentally rethink their planning processes. Traditional corporate strategy focuses on financial performance and operational efficiency. As climate risks and opportunities become increasingly material, however, a holistic approach is essential. This means embedding climate into core business objectives and recognizing sustainability as a driver of innovation and resilience.

This article delves into three key unlocks for effectively weaving climate into corporate strategy:

• Using climate-based scenarios to guide decision-making;

• Prioritizing decarbonization levers per organizational goals and context; and

• Implementing adaptation and resilience measures that address immediate risks with minimal resources and maximal co-benefits.

Use climate-based scenarios to inform strategies

Strategic foresight is crucial for mitigating risk, driving growth, maintaining regulatory compliance, bolstering investor confidence, and enhancing reputation.

Climate-based scenario analysis is a key tool for foresight, but it remains underutilized: only around one-third of organizations disclosing to the CDP have implemented it. While not predictive or exhaustive, this approach helps organizations navigate uncertainty and enhance corporate resilience by accomplishing the following:

• Identifying plausible impacts of climate change and low-carbon transition, both adverse and beneficial.

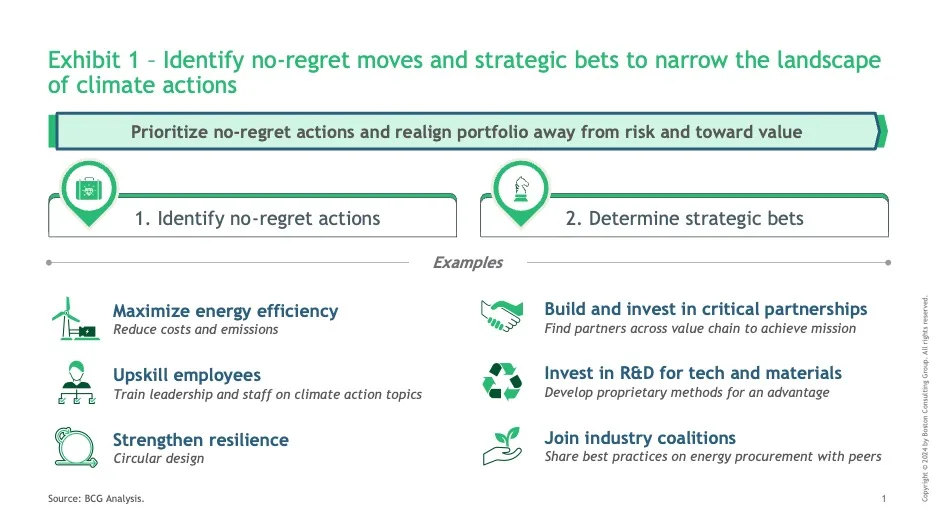

• Aligning on actions to address risks and opportunities, as well as achieve strategic and climate goals. These actions can be separated into no-regret moves now and strategic bets for future success (see Exhibit 1). This exercise also helps companies balance ambition of strategies with feasibility of execution, which is critical for corporate climate action.

• Pressure-testing business plans against various conditions to uncover roadblocks, failure points, and key success factors.

Critically, climate-based planning cannot be separate or parallel to “regular” planning, but rather be deeply integrated into existing processes.

To address common challenges of climate planning within corporate planning cycles (ensuring climate data availability, aligning with financial reporting timelines, etc.), companies may consider the following:

• Methodology and data: Establish market-aligned, company-wide frameworks for meaningful data comparison and aggregation; use localized data for accuracy; and start with widely accepted scenarios (for example, 1.8°C for transition risks and 2.7°C for physical impacts). One utility company originally performed analyses using a 4°C scenario, but failed to gain buy-in as impacts seemed too far-fetched. It intends to repeat the exercise with a more widely accepted scenario and work its way up.

• Operational integration: Involve asset managers and operations teams for on-the-ground knowledge; include supply chains in assessments; and communicate severity of risks in operational and financial terms that highlight materiality and urgency while acknowledging uncertainty.

• Compliance requirement: Consider mandating climate risk quantification as a compliance requirement to institutionalize the practice and drive continuous improvement, much like the evolution of health and safety regulations once they became mandatory in corporate contexts.

• Ongoing refinement: To monitor ongoing feasibility of climate initiatives, establish reporting mechanisms for on-the-ground teams to promptly notify central sustainability teams of implementation progress, such as templated feasibility reports.

Blueprints for Success

Philips is involving site managers and finance teams in asset-specific risk analyses to assess potential financial impacts across scenarios. It is also implementing a central risk assessment survey for greater comparability across locations and integrating the results into financial reporting.

Similarly, Nestlé has embedded climate-based strategic planning into its core processes, with materiality outcomes informing a sustainability strategy that prioritizes water efficiency, 100% renewable electricity, and sustainable sourcing.

WBCSD Member Insights

A food and beverage player is leveraging an adaptation and resilience (A&R) roadmap progress form to generate feasibility reports. Business units indicate roadblocks that are hindering the delivery of the enterprise plan, thereby giving the central sustainability team a clear view on how to better support implementation.

Prioritize decarbonization levers in line with organizational goals

Reducing emissions requires a coordinated effort to identify, prioritize, and deploy decarbonization levers. Marginal abatement cost curves (MACCs) are a powerful tool for comparing the lifetime cost and abatement potential of decarbonization levers on a like-for-like basis (see Exhibit 2). They highlight the processes that drive emissions reduction potential, and outline efficient, cost-effective pathways to meet targets. Notably, MACC analyses show that, on average, approximately 50% of Scopes 1 and 2 emissions reduction for a company can be achieved at net zero cost (the exact percentage will vary by industry, ranging from 20% to 30% for shipping to well over 50% for consumer packaged goods). Practically, companies tend to start with levers that save costs, and over time start to address other levers.

To inform lever prioritization, companies may consider additional factors based on organizational context.

The following are four takeaways on using MACCs:

Blueprints for Success

Mars has effectively used MACCs to inform decarbonization strategies and its Net Zero Roadmap. Based on the assessment of over 500 levers, Mars’ MACC analysis:

• demonstrated that its decarbonization goals can be reached affordably at less than 1% of total sales;

• highlighted key business segments, products, production mechanisms, and procurement strategies driving reduction potential; and

• facilitated constructive, solutions-oriented discussions between the sustainability team and stakeholders across the organization.

Leverage adaptation and resilience quick wins

Climate risks seem remote to many stakeholders, as people tend to think in terms of the current quarter and the next year, versus 2050 or 2100.

– Challenges identified by practitioners

As climate-related impacts grow, companies can plan for long-term adaptation and resilience efforts. However, many companies noted that this can create tension as strategic planning typically follows a three-to-five-year cycle, while climate-related risks are often perceived as distant or abstract concerns. This disconnect makes it challenging to integrate adaptation and resilience (A&R) into near-term business planning.

In light of these prevailing sentiments, it is important to emphasize that A&R efforts are not solely about long-term resilience—they are equally about survival in the next business cycle, as many climate impacts are already evident today. In 2024, for instance, Porsche was forced to delay vehicle production (representing 11% of deliveries) when flooding shut down a key aluminum alloy supplier.

To begin addressing these challenges, companies can prioritize A&R measures that mitigate immediate risks, preferably through quick wins that require minimal resources and yield maximal co-benefits for other business objectives, such as greater supply chain resilience and potential savings. This can help generate buy-in that makes the organization more receptive to longer-term initiatives.

Diageo, for example, has identified water resilience as a priority given its heavy reliance on the resource. As such, it prioritizes water efficiency projects, behavioral change programs, and investments in water recycling and reuse technologies. Building on this priority, Diageo has since directed attention to other material risks.

The following tips can help companies make progress right away on A&R:

• Take stock of current initiatives, including those not explicitly categorized as climate- or sustainability-related (for example, business continuity plans that strengthen resilience), and build from these foundations.

• After thoroughly assessing climate risks, narrow down the long list to two or three priorities to be addressed immediately based on materiality and feasibility.

• Pursue A&R quick wins that require minimal upfront investment and may be able tobypass extensive business approvals.

• Demonstrate the immediate benefits of A&R measures, including risk mitigation and as co-benefits, to generate buy-in and momentum.

WBCSD Member Insights

An environmental services provider is contemplating shifting from a comprehensive, ambitious A&R approach to focusing on a just a few high-priority initiatives first, to build momentum.

No-regret foundational moves

Outline

Related

Content

Insights: Communicating Supply Chain Risk in a Climate-Disrupted World

12 June, 2025

Collaborative pathways for building resilience in transport: insights from ITF 2025

5 June, 2025

BCTI empowers Corporate Leaders to Take Action on a Just Transition, Human Rights, and Living Wages

27 March, 2025