This short insight note focuses on the role that finance has in supporting organizations to shape climate transition plans and to enable transformation.

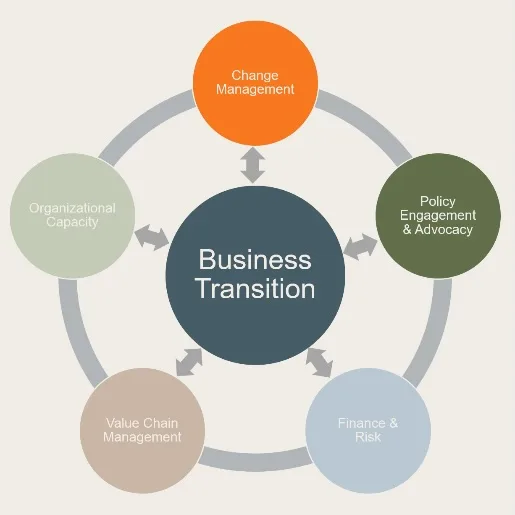

This series comprises of five insight notes focusing on key areas of business focus to “unlock” transition plans and build on insight and perspectives shared by WBCSD members who joined the Unlocking Transition Planning session held at our Council Meeting in New York in September 2024. Each of the areas are explored in an accompanying series of articles available here. An accompanying unlock focused on Risk will be shared in early 2025.

Importance of finance

Effective financial management begins with a realistic perspective about a company’s market conditions, and how that affects the value and prospects for a company’s business today. All material financial risks should be duly reflected in a company’s financial statements and in an organizational strategy that should reflect anticipation and management of those risks. Financial management also sets the course for a business’s future and is essential to executing organizational change.

Relevance to transition plans

The unavoidable impacts of climate change and the transition to a net zero economy alter the markets in which a company expects to operate. This has implications on relevant time horizons, impacting the value of assets on a company’s balance sheet today and in the future and the risk of climate-related liabilities. For example, a company that owns and operates a GHG-emitting industrial facility or a plant manufacturing GHG-emitting vehicles will need to plan for the risk of eroding value of those assets, as technology, policy, and consumer preference shifts towards non-emitting alternatives, or the risk of new liabilities from policy or the physical impacts of climate change. In transition planning, effective financial management begins with an understanding and disclosure of climate-related financial risks and opportunities, where material, and engaging relevant stakeholders on the business case for organizational change.

A transition plan should also imply a financially credible business case justifying the plan’s implementation. Organizations must be equipped to articulate the financial rationale of changes to ensure stakeholder buy-in and durability. Navigating a climate transition requires planning that is grounded in the financial evaluation of climate-related risks and opportunities and necessitates delivering plans that minimize risks and capture opportunities. Whilst it is recognised that capabilities to evaluate impacts are still maturing, capital markets and investors will use this information to evaluate if the business has a credible means to generate economic value throughout the transition.1

The transition to a low-carbon and resilient economy also involves significant investment, particularly capital investment in the processes, data and real assets of the net zero economy. At a company-level, much of that investment comprises the expense of retooling all or a material part of a business in light of the transition, such as investments into renewable energy resources, product innovations and new business structures. Financial planning is essential to allocate the resources required to carry out the investments necessitated by a transition plan.

Organizations must be equipped to articulate the financial impacts of navigating a transition to the capital markets, and where and how it creates new financial needs and contingencies. In many instances organizations will need outside investment to carry out their transition plans. Finance teams should work with investors and financial institutions to provide a clear picture of how their company is planning to transition, what the key areas of challenge are and how and where financial investment can support the businesses transition.2

Finally, companies with significant climate-related risks and impacts in their value chain may also be able to finance and enable transformation in other companies. This is explored further in our unlock article on value chains.

Financial institutions are essential to the capital formation that enables corporate operators to realize their transition objectives. The “key drivers” for unlocking transition plans outlined in this paper also pertain to financial institutions but with the following considerations:

Financial institutions must consider a broader set of climate-related risks and opportunities across their existing portfolio and the prospective markets, industries, and asset classes in which they invest. For example:

- Banks fund and support transition plans by allocating capital through project and corporate finance (loans, green bonds, and sustainability-linked financing) to sustainability- and transition-focused criteria. They integrate climate risk into lending decisions and incentivize decarbonization with innovative financial products.

- Investors influence companies to adopt transition plans by redirecting capital toward sustainable businesses, divesting from high-carbon assets, and monitoring performance against climate targets. Commonly, shareholder engagement is leveraged to ensure accountability.

- Insurers assess climate risks in underwriting, offer tailored products for renewable energy projects, and channel investment portfolios into transition-focused and green initiatives. They also incentivize low-carbon transitions through favourable risk pricing.

A financial institution’s ability to allocate financial resources into real-economy activity, for example enabling a company to build the capital assets of the net zero economy, requires an assessment of the near-term and longer-term performance of the company and a view on the capabilities of the company to deliver sustainability-linked objectives and transition goals. Therefore, a financial institution’s investments into their investee’s transition must evaluate their commitment, ability and credibility, to design and deliver transition plans that drive sustainable outcomes (as opposed to greenwashing investments with limited sustainable impact).

Key drivers for delivering transition plans

Build the business case for a transition

Unlocking a climate transition plan requires a clear and effective business case that is grounded in financial analysis. Business leadership needs to construct a compelling narrative that motivates the strategic imperative of transition; a narrative that transition plans are congruent with and advantageous to maintain financial performance. A strong business case should:

- Articulate the financial opportunity of implementing a transition plan against the risks of maintaining the status quo.

- Outline an organization’s process for identifying and minimising the financial risks imposed by changes to climate and natural systems.

- Evaluate transition strategies and business performance goals that are informed by robust scenario analysis that connect to the organization’s ability to create economic value over short-, medium-, and long-term time horizon.

- Contain the basis for the assessment of materiality and the criteria by which thresholds are set and measured (e.g. significant impact on financial performance or operations (SEC); company financial value (CSRD); financially significant to stakeholders (CDSB); impacts on enterprise value through future cash flows, access to capital or valuation (ISSB)).

- Align business investments with the transition plan through, e.g.,

- conducting financial analysis to evaluate how planned capital expenditures (Capex) support the company’s climate transition goals (e.g., net-zero targets)

- establishing metrics and targets to assess the climate impact of investments (e.g. carbon abatement potential, alignment with science-based targets).

- incorporating climate transition considerations into budgeting, capital allocation frameworks, and ROI assessments.

- ensuring investment proposals include climate risk-adjusted returns, integrating both financial and non-financial metrics.

- Reflect a clear understanding of critical business model dependencies and investment needs in a transition and how financial risks associated with transitioning the business can be managed through, e.g.,

- identifying and mapping business model dependencies affected by the transition, such as reliance on high-carbon inputs, energy sources, or customer demand in carbon-intensive sectors

- developing stress-testing and scenario analysis capabilities to assess financial risks under various transition pathways (e.g., carbon pricing, market shifts, or regulatory changes)

- collaborating with operational teams to assess investment needs for decarbonization (e.g., R&D for low-carbon technology, renewable energy procurement)

- establishing mechanisms to manage transition risks, such as hedging strategies for carbon price volatility or green bond financing for transition projects

- Leverage financial insight into the economic impacts of climate-related risks (e.g., revenue impacts, stranded assets) and the benefits of the transition plan (e.g., new revenue streams, cost savings from energy efficiency) to support robust communication to financial markets and capital partners, to make the value case and business case for transition.

- Build from the foundations provided by mandatory reporting frameworks like the ISSB and CSRD, and other resources articulating principles of transition plan credibility (e.g. guidance from the World Benchmarking Alliance and the Network of Central Banks and Supervisors on Greening the Financial System).

Utilize financial planning frameworks to allocate resources towards a transition

Financial resources are essential to carrying out a transition plan. Financial planning should ensure that there is consistency between the company’s investment plans – both existing and scheduled -and the investments required for its articulated transition objectives and strategies. It should:

- Build financial forecasts that reflect the investment requirements and revenue opportunities articulated in a transition plan.

- Integrate dynamic transition planning processes that enable financial planning to be updated in the context of evolving market conditions, policy changes, technology availability and cost, and consumer preferences.

- Ensure that transition objectives and strategies are integrated into the business’s investment processes, particularly capital planning and capital budgeting.

- Identify and resolve challenges in business governance, organizational structure and capital structure that prevent the company from investing in, or acquiring, the relevant climate solutions and business capabilities on which its transition plan relies.

- Align financial allocations and products to support the company’s strategic ambition, particularly in the business’s Capex and Opex.3 4

Engage capital partners and investors

Many companies have opportunities to leverage outside capital to support their transition. Increasingly, investors are developing financial products that help companies realize their climate transition strategies. To engage investors, a company can:

- Engage the public sector, which can provide financial resources to support transition objectives. This is particularly pertinent where public resources can address gaps in private market investment activities, provide better terms than commercial financiers, or provide enhancements that can attract private investors. Engagement with the public sector also provides an opportunity to be clearer on dependencies and policy needs for the financial viability of a transition plan (see the ‘Policy’ insight note).

- Engage private capital partners to identify the financial resources that are available to support transition objectives, particularly financial products that incentivize decarbonization and the realization of transition objectives such as green bonds, transition bonds, and sustainability-linked loans.

- Evaluate opportunities, if it has a strong balance sheet, to extend financial resources across their own organization’s value chain that enable transition objectives outside of their business’ operations.

Takeaways

A transition plan will often entail significant financial expenditures, especially capital investments; therefore, a credible one should articulate the investment needs, as well as internal and external sources implicit in the proposed organizational change. Transition plans must persuade existing and new investors and lenders of the rationale for organizational change, the expenditure associated with that transformation, and their role in enabling it.

By integrating finance-related actions within a transition plan, an organization builds a transparent and robust foundation for how the transition plan will be financed and delivered, ensuring alignment with market expectations and long-term resilience.

Key areas where finance can play a critical role include:

- Building the business case for transition – Develop a clear and credible financial case for climate transition plans, demonstrating how they mitigate risks and capitalize on opportunities.

- Utilizing financial planning frameworks – Align financial forecasts, investment plans, and capital allocations with transition objectives to ensure dynamic adaptation to policy changes, technology shifts, and market conditions.

- Engaging capital partners and investors – Leverage external capital through green bonds, sustainability-linked loans, and transition financing to support decarbonization and achieve climate objectives. Collaborate with public sector resources to fill investment gaps and support the financial viability of a transition plan.

- Extending financial resources across the value chain – Enable transformation within the value chain by extending financial resources to support decarbonization efforts beyond the company’s direct operations.

Contact

Corporate Performance & Accountability cp-a@wbcsd.org

1 See, for example, Lloyds Banking Group, Credible Transition Plans – Reporting vs Reality; Network for Greening the Financial System, Connecting Transition Plans: Financial and non-financial firms.

2 See for example, Apple’s issuance of green bonds to finance renewable and energy efficient projects; Novartis use of sustainability-linked bonds tied to social targets; Tesco’s use of structure bonds tied to reducing carbon emissions in its operations.

3 For example, Unilever integrates OpEx for energy efficiency upgrades in manufacturing plants and sourcing renewable energy for its operations. These recurring operational expenses directly contribute to reducing carbon intensity across its global supply chain.

4 Amazon invested heavily in renewable energy projects, including funding the construction of solar and wind farms globally. These Capex initiatives are part of Amazon’s Climate Pledge to achieve net-zero carbon by 2040.

Outline