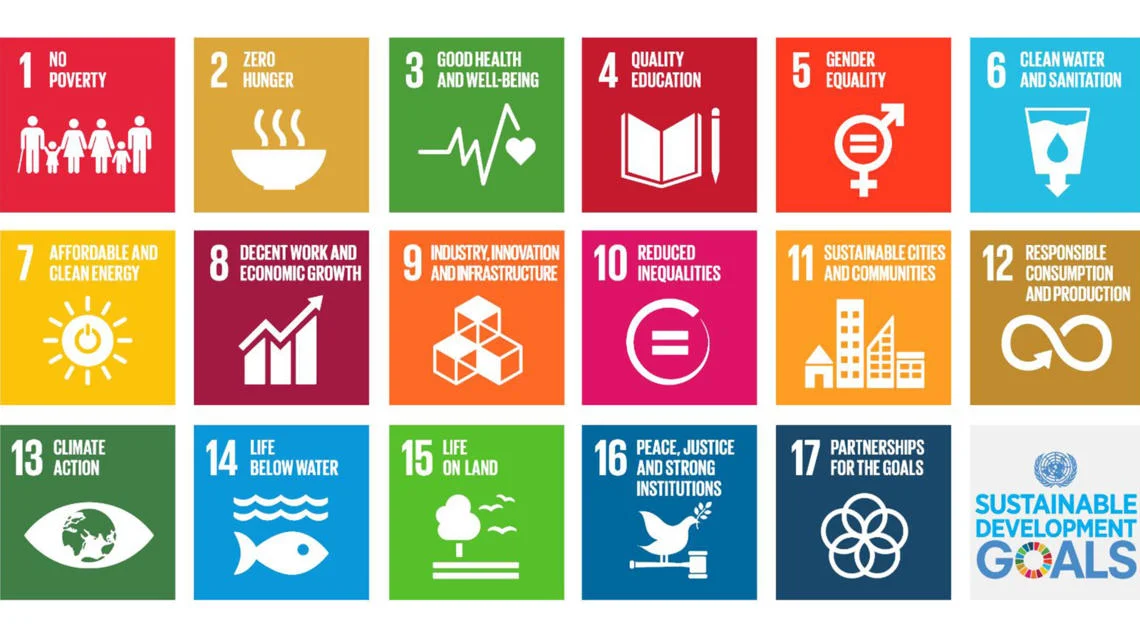

The Sustainable Development Goals (SDGs), which will shape the global development agenda from now until 2030, explicitly call on business to use creativity and innovation to address sustainable development challenges, such as poverty, gender equality, clean water, HIV/AIDS, access to energy, and climate change.

Here at the World Business Council for Sustainable Development (WBCSD), we are strongly engaged in translating the SDGs’ ambitions and words into business action underpinned by business solutions. We define solutions as business-led ventures that are impactful, scalable, measurable, replicable, and going beyond business as usual. These solutions enable companies to better manage their risks, anticipate consumers’ demand, build positions in growth markets, secure access to needed resources, and strengthen their supply chains.

In order to enable business action, we have most notably launched the SDG Compass, in partnership with the UN Global Compact and GRI (Global Reporting Initiative). Companies can use this guide to align their strategies with the relevant SDGs, and measure and manage their impacts. It is supported by a live and constantly updated inventory of business indicators and tools.

On the advocacy side, we have issued a joint statement alongside a wide range of business organizations and networks, underscoring the importance of the UN Guiding Principles on Business and Human Rights (UNGPs) as a powerful and critical companion to the SDGs.

Another notable example is our corporate WASH Pledge, signed by 36 companies so far, has secured access to safe water, sanitation and hygiene for 1.6 million people worldwide. This is a business-led initiative that secures access to safe water, sanitation and hygiene (WASH) for all employees at the workplace.

The above are just three examples showcasing how the WBCSD’s work aligns with this global agenda as well as our Action2020 platform, a science-based action plan we launched in late 2013 engaging companies to implement innovative and scalable business solutions and improve the business case for sustainability. More outputs will be shared over the course of the next few months. There will most notably be a CEO Guide on the SDGs, whilst the outputs of our Low Carbon Technology Partnerships initiative (LCTPi), which seeks to catalyze action to accelerate low-carbon technology development and scale up deployment with the aim of limiting global warming to below 2°C, will be presented at COP21 in Paris in early December.

Scaling up business solutions through corporate impact venturing

As a means of delivering a blueprint for creating business solutions, the WBCSD is supporting, alongside our member company Novozymes and a number of other corporate co-founders, the creation of DIVA, an innovative incubator focused on de-costing and de-risking business solutions addressing sustainability challenges.

DIVA is a not-for-profit incubator that can co-invest in for-profit impact ventures in partnership with large corporations, with a focus on early-stage business development requiring innovative models and partnerships. Such an incubator will enable companies to reach further and become more ambitious in creating impact and scaling solutions.

What is corporate impact venturing?

There are several pathways corporations can take to pursue business development, all of which can be impact-oriented. One of them is corporate venturing, which leverages people, ideas, technology and business assets to drive new forms of value creation, either alone or in a joint venturing approach. For corporations that are leaders in both sustainability and business development, corporate impact venturing is simply another pathway to organic growth, alongside more incremental business-building and acquisition-based approaches.

To succeed with corporate impact venturing, corporations need to create a whitespace that enables business model innovation as well as rapid and agile decision-making; to provide the right incentives, governance and resources; and to acquire the right capabilities through hiring, training and partnering.

DIVA’s approach: Leveraging catalytic funds to unlock the potential of commercial capital

DIVA is focused on bringing existing technologies, products and services to underserved markets by means of innovative business models and partnerships. Corporations bring in opportunities from their business development portfolios and work together with DIVA in a joint venturing process. Exit options are built into the process, providing maximum flexibility for the corporations in terms of their commitment and ownership. Acting as the anchor partner, DIVA orchestrates the venture development process end-to-end, forming coalitions around each venture as needed.

In essence, DIVA is a new form of not-for-profit intermediary that offers corporations, commercial investors, impact investors, and philanthropic foundations the opportunity to catalyze impact on multiple levels. It uses fit-for-purpose instruments together with special purpose vehicles that are optimized to let different types of capital providers work effectively together in tiered structures, matching the venture maturity and needs with the respective ROI requirements and risk appetites of the investors.

How does DIVA help?

DIVA encourages, facilitates and scales up business contributions to the SDGs by making the development of business solutions easier, cheaper, faster, more likely to succeed and therefore more attractive to both corporations and investors.

By bringing in deep expertise (in-house and through partnerships), DIVA reduces a corporation’s risk of engaging in impact ventures. By providing co-development services as part of a joint venture investment, DIVA also reduces the corporation’s initial cost of engagement. Further, by effectively leveraging its network of impact investors, DIVA reduces the time it takes to leverage external finance into a given venture. Finally, as a function of DIVA’s collaborative model, corporations have the opportunity to build out their own capabilities in sustainable business development.

For their part, venture philanthropists access a lower-cost and lower-risk model for deploying catalytic grants and program-related investments. There is also a greater likelihood of catalyzing significant impact, given the scaling capabilities of corporations. Impact investors lower due diligence costs and gain privileged access to a pipeline of high-quality deals, backed by strong organizations. Ultimately, the goal is to attract large-scale capital from commercial investors to finance the international scale up and replication of the most successful corporate impact ventures.

Watch this space

DIVA has brought on board an initial group of core stakeholders and is looking to partner with additional corporates to complete the first round partnerships and establish a cohort of impact venture opportunities.

Watch this space for more updates on DIVA and the SDGs in the coming weeks, including in connection with an issue brief to be jointly published by Deloitte and the WBCSD’s Social Impact Cluster on “Innovating for social impact: Five strategies for growth”.

For more information on DIVA, check out www.diva.ventures/ and contact co-founders Stefan Maard and Morten Møller Holst. The WBCSD’s contact point is Filippo Veglio, Director, Social Impact.

Outline

Related

Content

New insights on Nature-based Solutions: scaling up strategies for net zero, nature positive and addressing inequality

17 November, 2022

France: New study focuses on upscaling corporate solutions for biodiversity

8 March, 2021

Better together: How SDG Sector Roadmaps can help to unlock transformation

15 June, 2021