Agri-Food: The problem and the solution

It’s increasingly well-understood across the realms of policy, business, and finance that nature underpins the global economy (the European Central Bank being the latest to highlight this fact). From raw materials to ecosystem services such as climate regulation, water supply and soil health, business and society-at-large are dependent on the natural world. And yet, the latest assessments show we’re already well beyond the earth’s capacity to sustain life as we know it.

The post-2020 Global Biodiversity Framework (GBF) agreed at COP15 last year offers some hope, in aligning the public and private sectors to halt and reverse nature loss by 2030, with a view toward full recovery by 2050. The agri-food sector is understood to be the largest driver of nature loss, but also one of the top levers for nature- and climate-positive systems change. WBCSD’s Roadmaps to Nature Positive are outlining how businesses (including agri-food companies) can put themselves on a nature-positive path, in line with the GBF and linked closely with the global imperatives of climate and equity.

A Roadmap for the agri-food sector

The Agri-Food Roadmap to Nature-Positive will provide initial “how-to” guidance on applying High-level Business Actions on Nature within value chains, assessing and disclosing material risks and opportunities (aligned with TNFD), and preparing to set science-based targets for nature. The roadmap is designed for use along the full agri-food value chain, and across all stages of the nature positive corporate maturity journey. We’re working with a diverse group of agri-food and professional services companies, creating an approach that is both scientifically-rigorous and practical for business implementation.

The key questions we’re exploring include:

- Scoping: Where to focus, both within my value chain and geographically?

- Materiality: What to focus on, both nature-related dependencies and impacts?

- Risks & Opportunities: Why does this matter for my business and stakeholders?

- Priority Actions: What actions should I be taking, as a company and collectively? What are the key barriers and trade-offs to consider?

We will publish initial guidance in September 2023 in the run-up to COP28. Phase 2 of this work will extend into 2024, and will provide further critical guidance, identifying common metrics and indicators, and aligning on valuation and reporting approaches.

Landscape deep dives: Brazil, USA, Vietnam

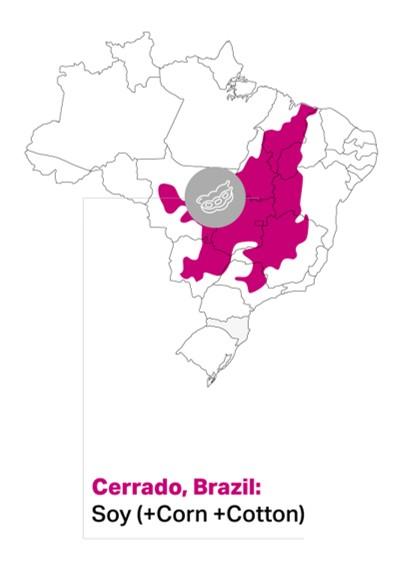

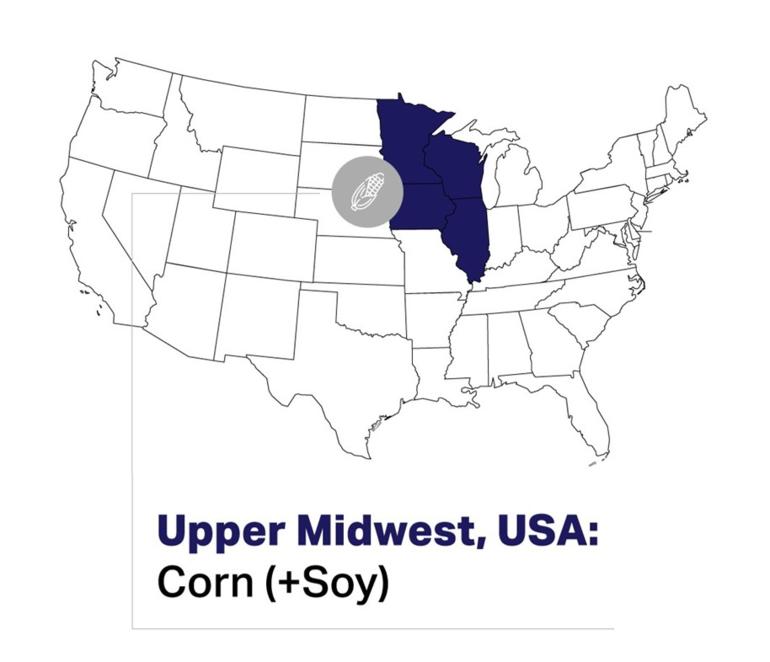

Nature impacts and dependencies are highly local. We have therefore undertaken “deep dives” into three landscapes of anticipated agricultural expansion, containing biodiversity hotspots, and considered key operating/sourcing regions of the WBCSD member companies engaged. These deep dives are exploring key nature-related pressures, leading practices, key resources, and remaining challenges around soy production in the Cerrado region of Brazil, corn in the Upper Midwest, USA, and rice in the Mekong Delta, Vietnam. Additional landscapes may be added in Phase 2.

What are we learning?

Start with screening – but don’t stop there: Agri-food value chains are long and complex, often involving many different commodities, and hundreds or thousands of suppliers. Leading frameworks advise starting with sector-level screening to understand your nature-related impacts and dependencies, using publicly-available tools such as ENCORE, the WWF Biodiversity Risk Filter, and the SBTN Materiality Tool. Indeed, there is a wealth of information available to get started, but the next step is critical: assessing your own operations and value chains, and gathering relevant stakeholder input. We have gained deep insights from landscape-specific interviews with private sector actors, producers groups, academics, public agencies, conservation organizations, and others.

For example, in a conventional rotation of soy-maize-cotton in the Cerrado region of Brazil, the top pressure on nature stems from land-use change, or the clearing of forests or native vegetation to make room for agriculture, which has a significant carbon and environmental footprint. But of the three crops, cotton has greater nature-related impacts (higher water consumption, pesticides use, soil erosion, and processing impacts). And considering the full annual crop cycle, which is mostly rain-fed, we find that water use is a relatively lower pressure driver here than sector-level screening would indicate. For a corporate actor involved in this value chain, these are important nuances to inform what to focus on, where, and how.

Put producers at the center: Wherever a company sits in the agri-food value chain, all roads point to the producers on the front lines of nature-related pressures and opportunities. We must prioritize their realities and needs, and seriously engage them in developing solutions. Our findings reinforce recent research showing that the biggest barriers to change are related to systemic forces (e.g. policy, financing, market and consumer dynamics) and farmer behavior change, rather than strictly technical considerations.

For example, in diverse landscapes across the world, expanding regenerative agriculture practices is essential to restoring soil health degraded by decades of mono-cropping and overuse of agri-chemicals. Training is key, but producers also need reliable market signals, e.g. to protect native vegetation or to be able to sell novel cover crops like red clover. Agri-food companies can take the lead in developing these markets, especially when aligned with policymakers, banks, retailers and other key players. As one biodiversity expert and lifelong corn farmer in Minnesota told us, “If we build the markets, farmers will plant [the cover crops]!” And in the Cerrado, the Soft Commodities Forum has initiated a multimillion-dollar “Farmer First Clusters” fund to incentivize soy growers towards deforestation- and conversion-free practices.

Identify trade-offs & barriers: Conventional agriculture is one of the main drivers of nature loss and climate impacts; given the sector’s high dependence on nature it’s rare to find pure win-win solutions. Our roadmap is identifying key barriers to change and trade-offs among the highly interconnected challenges of nature, climate and social equity. We may not have all the solutions today, but it’s important to first identify the challenges in order to drive collective action.

For example, new research shows in the medium-to-long term regenerative practices can have a significant, positive impact on crop yields and producer incomes. Yet in the initial years, the transition can bring increased costs and lower yields, as farmlands go through significant transformation. So we must identify and promote ways to balance the nature and climate benefits with the impacts on farmer livelihoods, as well as the need to feed a still-growing world population. In landscapes dominated by smallholder producers – such as rice production in Vietnam’s Mekong Delta – getting this right is particularly critical as a matter of daily subsistence.

Leverage existing resources: Our ongoing TNFD piloting and engagement in sector guidance development are providing direct insights into the roadmap development. We’re also aligning with WBCSD and partner programs in key landscapes to inform our deep dives; for example, the Soft Commodities Forum is a key knowledge partner on soy production in the Cerrado; similarly, the Sustainable Rice Landscapes Initiative is informing our research on rice production in the Mekong Delta. It’s also critical to link across sectors, for example with the Forest Sector on land-use issues, and Energy Systems on considerations around food crops and biofuels demand.

Remaining questions: Some of the thorny issues we continue to work through include alignment on “spheres of control and influence” (for commitments, activities and outcomes), and the associated metrics and data needs up and down the value chain. For example, “upstream” players such as agri-input providers will have a very different perspective as compared to a “downstream” trading company or brand. And data availability, consistency and quality – from the farm to the supermarket – continue to present challenges for system-wide transformation. Fortunately, we can leverage ongoing leadership on these topics by Regen10, OP2B, SBTN, TNFD and many others.

Looking ahead

Over the coming months we will be finalizing our deep dives through a stakeholder review, and developing a sector-level summary to sit alongside complementary roadmaps for the Built Environment, Energy System and Forest Sector. As the saying goes, “Perfection is the enemy of progress” – this space will continue to evolve, but we know the private sector cannot delay if we plan to bend the curve on nature loss this decade. WBCSD’s Roadmaps to Nature Positive are charting a path forward for the sectors – like agri-food – with greatest potential for transformative change.

Interested to learn more or get involved? Please reach out to inbusch@wbcsd.org