Kering: Environmental Profit and Loss (EP&L) accounting

Kering is a pioneer in Natural Capital assessment having created Environmental Profit and Loss (EP&L) accounting to measure, monetize and manage our environmental impacts in our own operations and across the entire supply chain.

The EP&L analysis reveals the true impacts resulting from Kering’s business activities and helps us find effective solutions to mitigate our footprint. In turn, this allows us to better address climate change and develop more resilient business models, as well as providing transparency to our stakeholders along the way.

Aligned with our open-sourcing philosophy, Kering’s EP&L methodology contributed to the Natural Capital Protocol development. Making it open-source aims to help advance the inclusion and adoption of Natural Capital accounting into mainstream decision-making and corporate reporting.

Kering also developed an easy to use tool, the "My EP&L" App, to assist the fashion community in understanding how design decisions influence the extent of environmental impacts such as material choices, sourcing regions, etc.

- Yes

- Biodiversity & Ecosystem Services

- Climate & Air Emissions

- Energy

- Land

- Materials & Resources

- Waste Management

- Water

- Corporate

- Product

- Project

- Monetary

- Quantitative

- Value to business

- Value to society

- GLOBAL

- Law & order

- Skills & knowledge

- Direct operations

- Downstream

- Upstream

Key findings

Kering publishes our Group EP&L on an annual basis. The EP&L is used as a day-to-day decision-making tool and is fully embedded into the business.

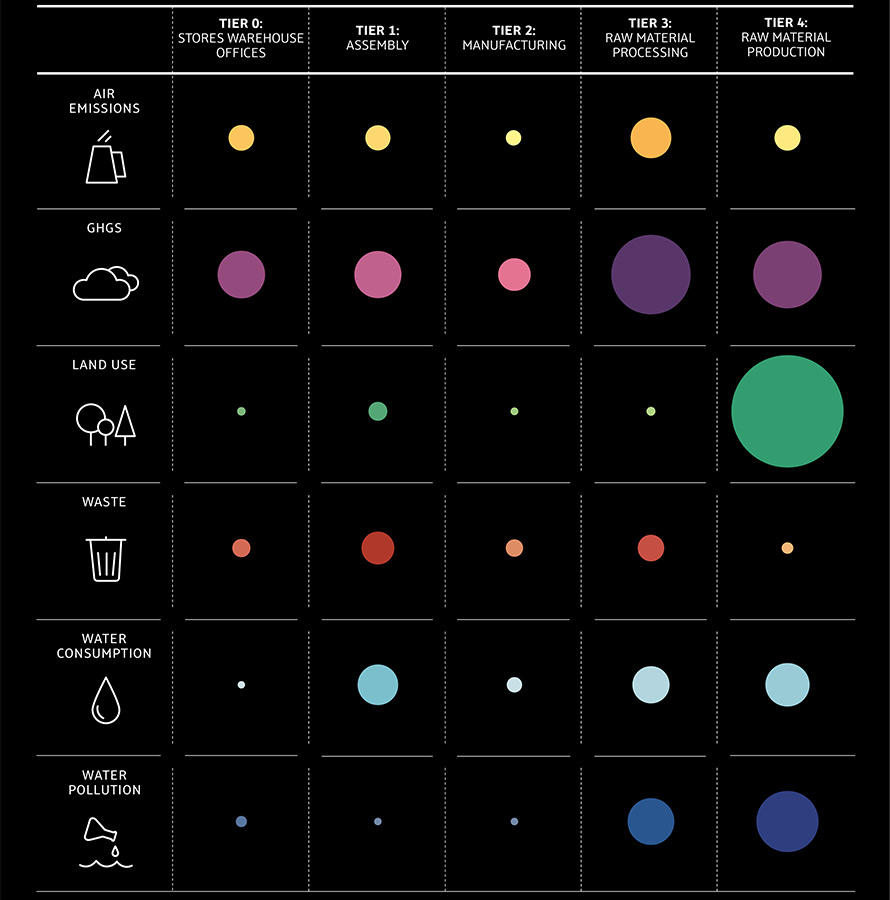

Among the lessons learned and key findings, Kering’s EP&L revealed that 93% of our impacts lie in the supply chain and, in particular, from the production and processing of raw materials which together represent 72% of the total. Our own operations represent only 7% of the impacts. Accordingly, Kering shifted focus to finding innovative solutions and leveraging changes across the supply chain, as well as avoiding high impact sources due to an increased transparency via the EP&L. Kering is currently expanding our natural capital accounting work to assess biodiversity and also linking natural capital accounting to Planetary Boundaries.